Introduction

In July 2025, the U.S. House of Representatives passed the Digital Asset Market Clarity Act (CLARITY Act)**. The legislation creates explicit jurisdictional divisions for digital assets, assigning oversight of digital commodities to the Commodity Futures Trading Commission (CFTC) and securities-related instruments to the Securities and Exchange Commission (SEC). By formalizing agency responsibilities, the act introduces a structured legal foundation for how crypto-native infrastructure must operate.

This change removes ambiguity from core protocol operations and provides institutions with the legal confidence required to assess digital asset exposure.

Defined Oversight for Crypto Systems

The CLARITY Act establishes a clear line of responsibility between agencies. The CFTC will supervise public blockchain assets and non-security tokens. The SEC will remain the primary authority for instruments resembling investment contracts or tokenized equity.

This division is not interpretative. Protocols, infrastructure providers, and custodial systems now face direct expectations tied to asset classification. The legal perimeter for launch, custody, and integration has moved from speculative interpretation to formal alignment.

Design Implications Across Infrastructure

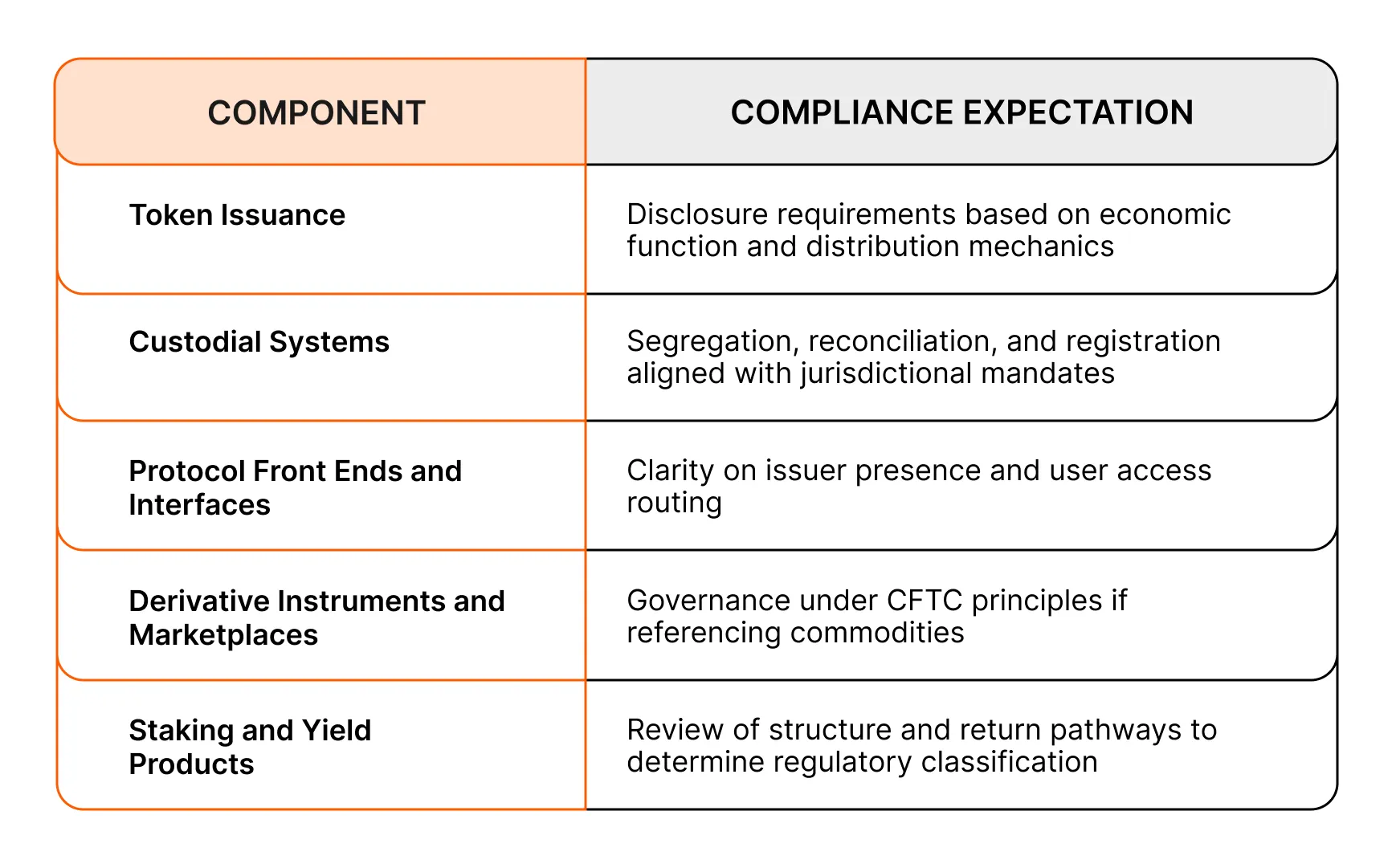

Digital asset systems operating in the U.S. or serving U.S. persons must now map their core logic and business architecture against agency standards. Areas of scrutiny include:

These requirements reshape design assumptions. Protocols built to scale will need provable alignment across legal, financial, and technical dimensions.

Institutional Alignment and Regulatory Signaling

With the passage of the CLARITY Act, institutions have a concrete framework to assess the legitimacy of digital asset systems. Engagement no longer rests on internal legal interpretation. Due diligence now follows structured criteria rooted in jurisdictional alignment, auditability, and operational transparency.

Asset managers and infrastructure providers will direct participation toward systems demonstrating robust internal governance, validated security properties, and traceable custody and issuance logic. The presence of legal clarity accelerates standardization. Institutional capital consolidates around protocols capable of demonstrating regulated posture.

Cantina’s Role in Regulatory-Ready Infrastructure

Cantina enables digital asset organizations to meet emerging institutional thresholds by embedding clarity, structure, and verifiability into core systems. This work spans:

- Source-level reviews of token contracts, issuance logic, and upgrade mechanisms

- Security validation across custody systems, access roles, and administrative flows

- Scenario simulation for redemption mechanics, control paths, and oracle reliability

- Documentation frameworks designed for internal compliance, investor relations, and regulator engagement

Cantina produces high-signal security outputs aligned with long-term operational trust. Our work supports organizations preparing for regulated environments, institutional partnerships, and cross-jurisdictional deployment.

Web3SOC: Institutional Classification for DeFi Organizations

Developed by Cantina in collaboration with leading digital asset firms, Web3SOC offers a structured system for classifying DeFi protocols according to institutional readiness.

It provides:

- Scoring across operational, financial, security, and regulatory dimensions

- Transparent breakdowns and confidential benchmarks to guide maturity

- A registry that signals standing to prospective institutional partners

The assessment process begins with Cantina reviews and culminates in a classification that reflects how an organization aligns with institutional diligence requirements. Web3SOC aims to become a decision-making tool for both investors and protocols pursuing regulated participation.

Next Steps for Infrastructure Alignment

The CLARITY Act will move to the Senate before entering the implementation phase. Regardless of timeline, the signal is operational. Organizations preparing to access capital markets, regulated custodians, or institutional partnerships must align architecture with legal expectations.

That process includes:

- Issuance and custody documentation that maps to agency expectations

- Reconciliation between on-chain activity and disclosure requirements

- Governance models that support enforceability, role clarity, and administrative review

- Infrastructure reviews that validate system integrity at the level institutions require

Cantina equips organizations to meet these demands with the tools, structure, and credibility institutions now expect.

Contact us to prepare your infrastructure for regulated integration.